It’s the time of year for making New Year's resolutions and for all those house goals we’re here to help!

Welcome to Planuary! If you’re looking to save a deposit and move home in 2021 then stay up to date with our latest articles throughout January to help you plan your shared ownership journey.

We hope we can help you save, plan and move into a perfect place to call home, and in this article we’ll provide you with some free resources, top tips and also take you through the main steps in the first stage of your new home journey.

Step 1 - Do your research

First things first when it comes to moving home – and that’s to do some research. With so much conflicting information out there we know that finding the right home for you may seem like a never-ending task, and that’s why we’ve created a Fact vs Fake article to provide information on what’s true and what’s not when it comes to shared ownership. Whichever house-buying scheme you decide to choose, make sure you do your research and select the option which is best for you.

Get an insight into the lives of real shared owners

If you’re interested in learning more about shared ownership, then you can hear from real Sovereign shared owners to find out their personal experience and how they manage their spending and finances. Simply take a look at our discover page to view our Money Diaries series. One example gives an insight into the life of a 27-year-old shared owner on £34k with a one bedroom shared ownership home in Berkshire. Alternatively, view our case studies page for more shared owner stories.

Step 2 – Ask yourself, what do you want in a home?

Before you start your house search, consider what you need and what you're looking for in a home. Examples include:

- Location - We have homes across the South with a range of different surroundings. Have a think and note down whether you would prefer to live in an urban, suburban or rural location.

- Property - Do you have a preference on whether you would like a new-build or resale property? We have a range of new-build homes as well as a variety of pre-owned properties (also known as resale properties) on offer too. The choice is yours!

- Space - Think about space. What is the minimum number of bedrooms you would need? Also consider how many parking spaces you would require.

- House Type - Is there a particular house type you have in mind? Examples include a semi-detached house, a second-floor apartment or perhaps a coach-house.

Figure out what type of home will work best for you and you’ll be one step closer to achieving your goal. Get in touch with our team about your preferences along with using our free resources in this article to make finding the right property a smoother process.

Step 3 – Get organized. Preparation is key!

When it comes to the first steps of moving home, it’s important to prepare as much as possible. Useful things to consider include –

- How much you will need to save for a deposit

- When you will need to save for a deposit by

- What new items you will need to purchase when moving

Take a look at some useful resources below to help prepare you for your moving journey. Alternatively, read through our latest articles on simple ways to save money for a deposit and 4 apps to help you save for a deposit which help make it easier to put those pennies away.

Penny Saving Challenge

We’ve all heard of the saying ‘every little helps’ and with the Penny Saving Challenge you could save over £600 in a year! Each day you save what you saved the day before, plus a penny more. For example, start by saving 1p, then 2p, then 3p a day and so on. By the end of December, the extra money you save could be put towards your deposit or buying new pieces of furniture for the home.

Top Tip – Try taking part in the penny saving challenge in reverse order. For example, start by paying £3.65 and then minus a penny from how much you save each day going forward (£3.65, then £3.64, then £3,63 etc). Doing this could help keep savings to a minimum in the lead up to the most expensive time of the year come December time – when it tends to be the hardest to save!

Click here for more information on the 1p saving challenge.

Savings Tracker

Easily monitor your progress by using this free printable tracker. This resource is a great way to review whether you are on track to meet your objectives in a specific time frame. To add some excitement when saving for a house you’ll be able to colour in more of the jar each time you add to your deposit, watching the jar fill up as you get closer to your goal!

- Download your personal savings tracker in purple here.

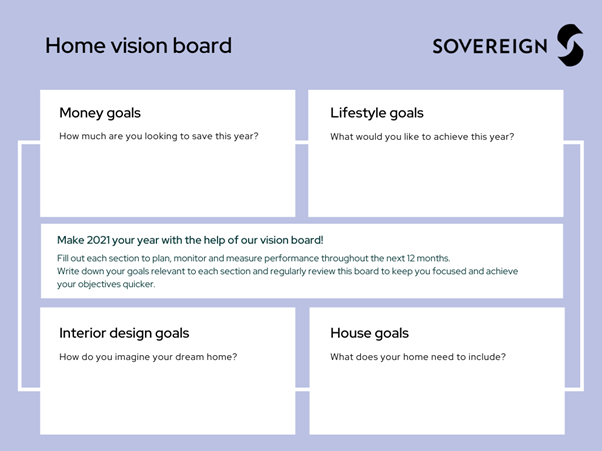

Home Vision Board

Download our home vision board to help you plan, monitor and measure performance against your house goals throughout the next 12 months. Simply note down what you would like to achieve in 2021 and regularly review this to keep you focused and motivated. This board includes sections on money, lifestyle, interior design, and house requirements – all of which will help you find a home most suited to you.

Furniture Spreadsheet Tracker

Once you’ve planned out what you’re looking for in a home and what you’ll need to save in order to get there, you can start thinking about what’s going to go in your home! To be best prepared, we recommend creating an item tracker which will enable you to plan what you need to get in advance and allow you to save accordingly. Simply list what items you need for each room to get started!

What next?

Once you have done your research, decided what you want in a home and planned what you need to achieve this, you will need to start planning the process of selecting and applying for a new home. Check back next week for more information on how to approach the next stages of your moving journey.